VaR Cult

Join the sacred brotherhood of risk obsessives who worship at the altar of mathematical doom. VaR disciples gather here to commune with statistical suffering.

The term "value-at-risk" (VaR) did not enter the financial lexicon until the early 1990s, but the origins of value-at-risk measures go further back. These can be traced to capital requirements for US securities firms of the early 20th century, starting with an informal capital test the New York Stock Exchange (NYSE) first applied to member firms around 1922.

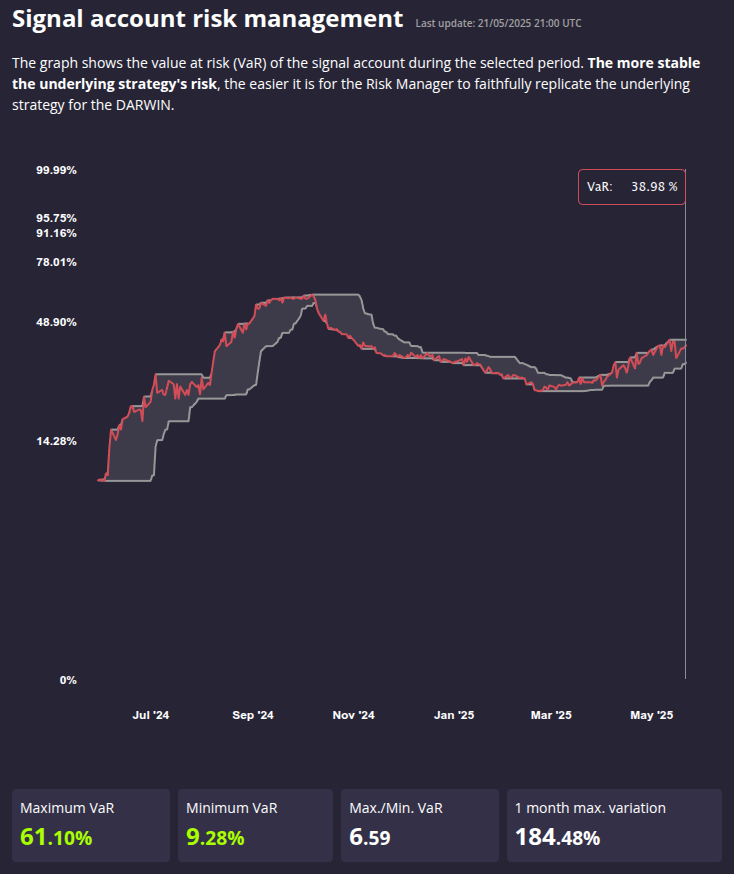

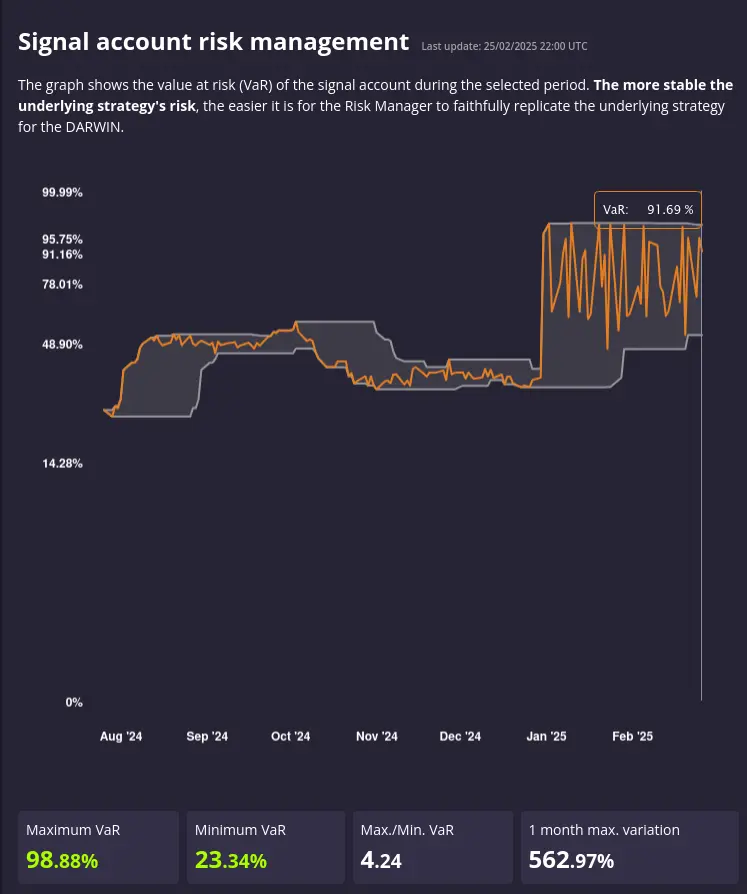

Behold, the first VaR warrior showcasing the absolute power of VaR Whipsaw. [WBYE]

Now that the whipsaw has concluded, and the short-heavy swing positions are in play. VaR will trend overall trend down, except for when longs are taken again on the account (after margin is freed and profits are taken).

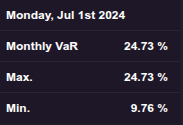

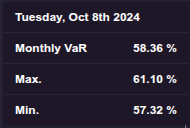

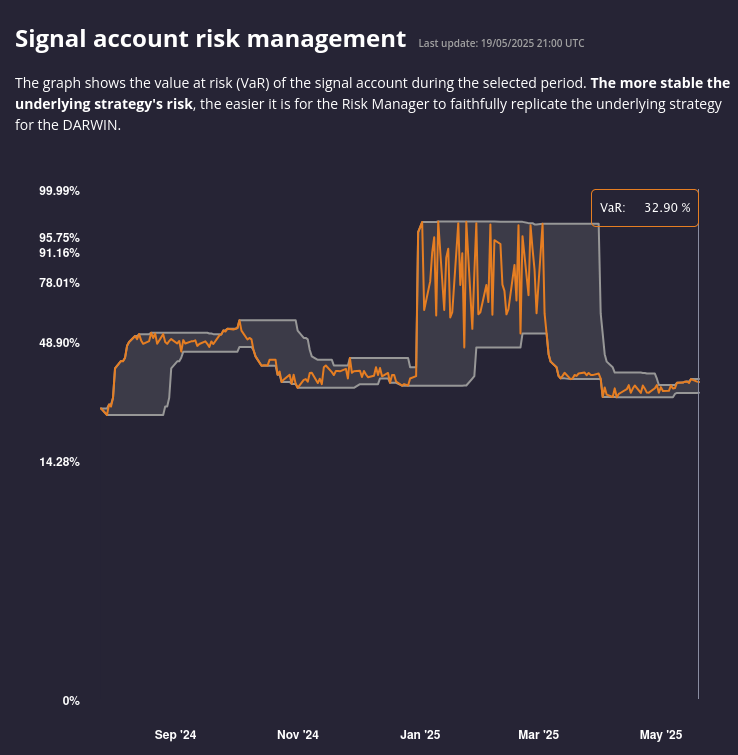

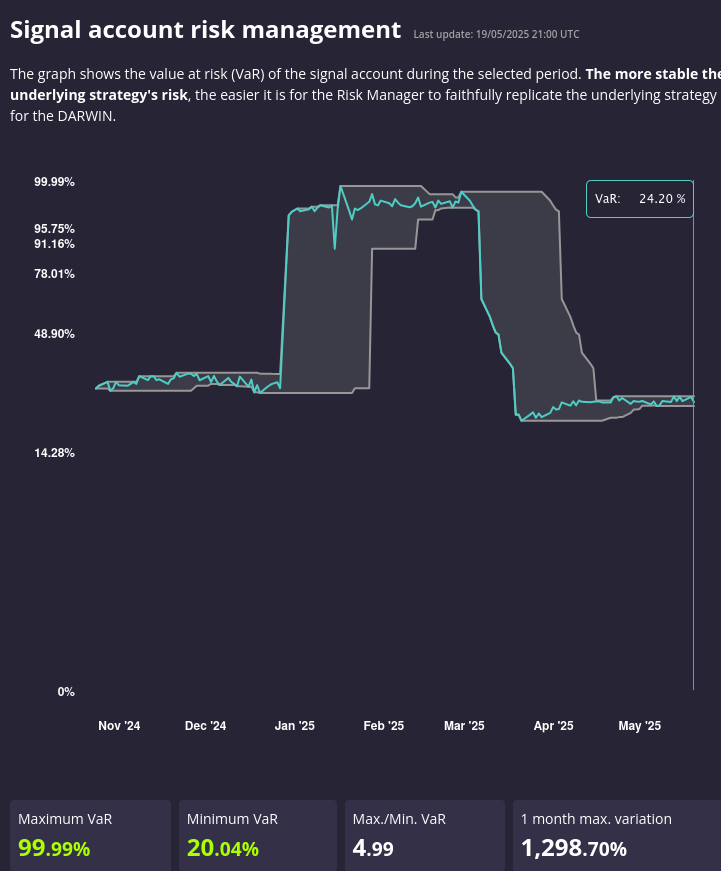

The below DARWINs showcase the power of a profitable swing short.

[ATPK]

[SWOF]

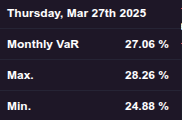

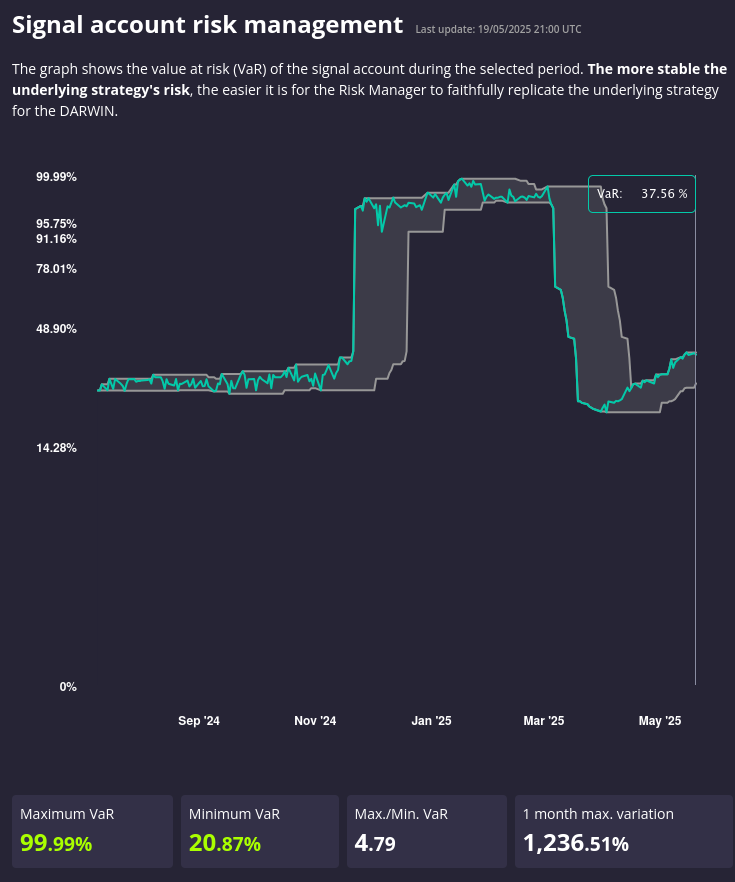

[HAKR] displays the life of VaR on a profitable swing long (held from 07/01 -> 03/28).